Horological Investment Mastery

Master the art of horological investing with our expert insights, meticulous market analysis, and exclusive access to investment-grade timepieces.

Market Insights

Unlock comprehensive market performance data and appreciation projections for rare timepieces.

Expert Consultation

Benefit from personalized investment strategies developed by our certified horological appraisers.

Authenticity Guaranteed

Our rigorous authentication processes ensure every investment piece represents true value.

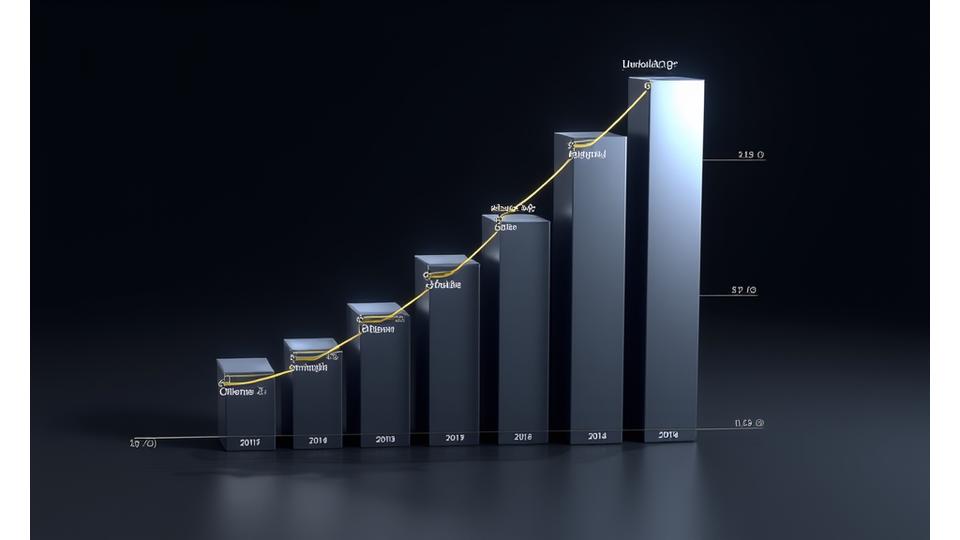

Market Trends & Performance Analysis

Understanding the intricate dynamics of the luxury watch market is paramount for astute investing. Our analysts meticulously track historical appreciation data across various categories, identifying patterns and predicting future trajectories.

- Verified appreciation data for vintage and modern classics.

- In-depth insights into emerging investment opportunities.

- Brand-specific performance analysis across global markets.

Identifying Investment-Grade Timepieces

Not all luxury watches are created equal when it comes to investment potential. Our expertise guides you through the critical criteria that define a truly investment-grade timepiece.

Rarity & Exclusivity

Limited production, unique complications, and historical significance drive value.

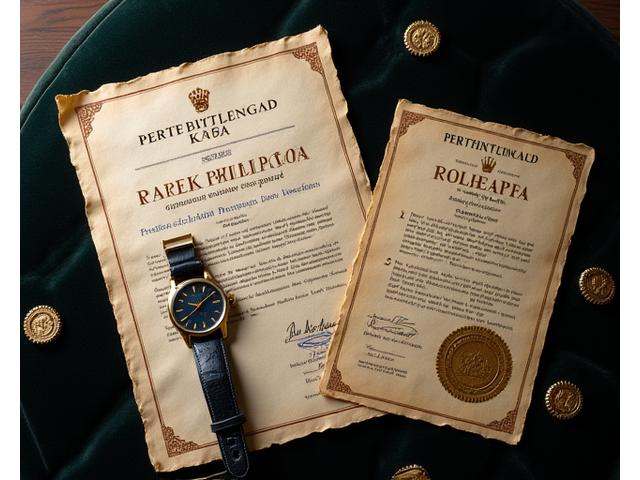

Provenance & Condition

Impeccable documentation and preserved original condition are crucial for appreciation.

Brand Heritage & Reputation

Trusted manufacturers with a legacy of innovation and timeless design yield higher returns.

Professional Authentication & Valuation

The absolute integrity of your investment piece is paramount. Our team of certified horological appraisers and authenticators employs a rigorous, multi-point inspection process, ensuring every watch meets the highest standards of authenticity and condition before valuation.

- Certified and independent appraisal services.

- Comprehensive historical and forensic authentication.

- Accurate market valuation and insurance documentation.

Building Diversified Collections

A truly robust horological portfolio is one that is strategically diversified. We guide you through nuanced strategies to mitigate risk and maximize potential returns across various categories and eras.

-

Balanced Portfolio Approach

Combine vintage rarities, contemporary limited editions, and emerging brands for optimal stability.

-

Geographic Market Considerations

Leverage insights into regional market trends and collector preferences.

-

Risk Management Strategies

Develop a resilient collection that withstands market fluctuations.

Expert Collecting Resources

We provide an unparalleled library of resources, curated by leading horological experts, to empower your collecting journey and deepen your market understanding.

Exclusive Market Reports

In-depth analyses of market performance, emerging trends, and value drivers.

Collector's Guides & Insights

Essential reading for seasoned and aspiring investors, covering everything from provenance to preservation.

Expert Interviews & Webinars

Gain direct insights from industry leaders and successful collectors.

Professional Investment Consultation

Elevate your horological portfolio with personalized guidance from our seasoned experts. We offer bespoke consultation services designed to align with your unique investment goals.

-

Personalized Strategy Development

Crafting a unique investment roadmap tailored to your aspirations.

-

Portfolio Optimization & Review

Regular assessments and dynamic adjustments to maximize growth.

-

Market Timing & Acquisition Guidance

Leveraging opportune moments for strategic acquisitions and divestments.

Ready to build a legacy? Schedule your confidential consultation today.

Schedule Consultation